The Central African Republic’s Sango initiative presents a new model for how states can leverage crypto to complement other development finance instruments.

How to mobilise private capital to close the SDG funding gap?

Before turning to the Sango initiative, it’s important to first refresh our understanding of the problem that Sango is attempting to address.

In 2018, the Brookings Institution published a paper on how to address the existing funding shortfall for the sustainable development goals (SDGs). Written by George Ingram and Robert Mosbacher, the paper highlighted how $2.4 trillion per year of additional investment was required to reach the SDGs by 2030. And that was before the pandemic.

Ingram and Mosbacher also referenced an estimate showing how achieving the SDGs could unlock up to $12 trillion in investment opportunities across a number of commercial sectors.

For the two writers, a promising solution to close the SDG funding gap is to “increase foreign and domestic investment in low- and middle-income countries by ramping up the engagement of the development finance institutions (DFIs) and the multilateral development banks (MDBs)”.

The writers emphasise how DFIs and MDBs need to facilitate more private capital investment in developing countries and work together to “co-lend, co-invest, and make substantially more capital available at affordable rates”.

In identifying the roadblocks preventing DFIs and MDBs from doing more, Ingram and Mosbacher take particular aim at MDBs. They point out how for every $1 of capital that MDBs commit, they mobilise less than $1 of private capital when instead they should be mobilising $4 of private capital.

Ingram and Mosbacher blame this on the MDBs’ risk aversion due to fear of being downgraded by credit agencies: “They much prefer deals in more stable and predictable markets and they rarely take the higher risk tranche in individual deals, even though there is no player better suited to handle that risk.”

As a solution to the fear of downgrading, the writers suggest that MDBs create an off-balance sheet fund that supports high risk projects and receives contributions from both the public and private sectors.

The key takeaway from Ingram and Mosbacher is that there is room for improvement in the methods used by DFIs and MDBs to help low- and middle-income countries achieve the SDGs.

To be clear, that is not to say that DFIs and MDBs should step away, they are crucial. Rather, it’s that there’s room to explore other methods that can complement the important work that DFIs and MDBs do, especially around the mobilisation of private capital.

Enter Project Sango

The Central African Republic (CAR) has embarked on a bold experiment that will test whether a country can use crypto to meet some of its development financing needs.

Known as Project Sango, the initiative will involve revamping CAR’s legal system, issuing a cryptocurrency (Sango coin) that is redeemable for e-government services, and creating a special economic zone in CAR’s capital, Bangui, to attract crypto firms.

Through a public sale of Sango coin over the next twelve months, CAR aims to raise over $1 billion.

It’s no secret that CAR faces serious challenges, and as such, is perceived as high risk. As widely reported, it sits second last to Niger on the Human Development Index.

CAR’s financial situation is not ideal either, with Bloomberg reporting that half of CAR’s national budget comes from foreign donors. The country also sits on a vast territory, which, over the years has been subject to recurring internal strife.

As the International Finance Corporation notes, CAR needs to grow its private sector by attracting investment in key economic sectors in order to create jobs and ultimately grow state revenues.

CAR’s FDI Predicament

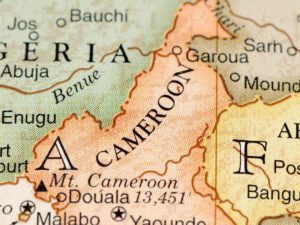

Like any other country, CAR wishes to attract as much foreign direct investment (FDI) as it can. However, CAR struggles to attract FDI, even when compared to the countries that border it.

As shown in the table above, all of CAR’s neighbours, excluding South Sudan, received more FDI than CAR in 2020 (latest data available). Indeed, Chad, the country ranked next above CAR, received 16 times more FDI than CAR in 2020.

In 2017, the Central African scholar, Dr. Yapatake Kossele Thales Pacific, published research on why CAR struggles to attract FDI. He found that low electricity supply, a lack of infrastructure, a shortage of skilled labour and political instability were key deterrents to FDI in CAR.

Here, CAR’s predicament becomes clear. To attract FDI, CAR needs to meet certain prerequisites, but in order to meet those prerequisites, CAR needs FDI.

To escape this trap, CAR needs a large infusion of capital with a high risk tolerance, and what better place to look than the proudly “degen” crypto markets. Recall, this lot spent over $40 billion on NFT art alone in 2021. It’s not a bad bet to think that nation building could capture their imagination, especially if such activity embraces crypto technology and is perceived to be furthering it.

Blending Crypto and Development

Sango Coin

In a nutshell, CAR has elected to build a new digital economy inside its borders with Sango coin at the heart of it. The initial utility of Sango will be to purchase e-residence, citizenship or land from the government. At a later stage, Sango holders will also be able to co-invest with the government in mining and infrastructure projects exclusively through Sango coin.

To jumpstart the Sango ecosystem, CAR intends to sell 20% of the Sango coin supply over the next year for roughly a billion dollars.

According to a press release, the proceeds from the sale of Sango coin will be invested in CAR’s mining sector. Presumably, the idea is to deploy this one-time injection of capital into an economic sector that can produce sustainable revenue going forward. CAR’s government reports that the country sits on over $3 trillion worth of natural resources.

The same press release also refers to the tokenisation of natural resources. The idea here is simply that, in the future, investors will be able to co-invest with the government in specific mining projects in CAR via locking up Sango coin in the Sango app for a set period. Profits from such investments would also be repaid through the app.

Of course, it remains to be seen whether there is enough market appetite to absorb $1 billion worth of Sango coin. The current macroeconomic environment has not been favourable to risk assets.

Nevertheless, an advantage the Sango coin sale has going for it is that it will run for a year, which is a long time in crypto. It’s not out of the question that over the next twelve months, the stars could align for Sango.

Country as a Platform

The model utilised by Sango coin and its underlying Sango blockchain is one we’ve seen in crypto many times.

For example, people buy Ether, the native cryptocurrency of the Ethereum blockchain, to pay transaction fees for activities they wish to carry out on Ethereum (e.g., issuing an NFT). The utility of Ether arises from the range of activities that users wish to carry out on the Ethereum platform. The more people and businesses building on Ethereum, the higher the demand for Ether.

With respect to CAR, Sango coin introduces a similar dynamic to that which we see with Ethereum and Ether. In CAR’s scenario, the state of CAR is the platform on which individuals and businesses build, and Sango is the cryptocurrency through which economic activity on that platform is channelled.

When investors first come to crypto and try to figure out where to invest, they are often overwhelmed by the thousands of active projects. Instead of trying to pick winners, some investors will simply invest in the layer one platforms (e.g., Ethereum, Solana, NEAR, etc.) that projects are building on. This is because they believe that a portion of the value generated by successful projects will accrue at the platform level since the activity of such projects creates a demand for a platform’s native cryptocurrency.

Sango coin introduces a similar dynamic where one can make a generalised bet on CAR’s economy simply by buying its official cryptocurrency. If one believes that the Sango ecosystem will see significant growth and activity, it follows that there will be great demand for Sango coin.

It’s easy to imagine a future of many country coins and that becoming the preferred way of gaining investment exposure to certain economies. Indeed, this approach could also work at regional and city levels as well, and perhaps even at lower levels of organisation than that.

The Country Treasury

Arguably, the true prize for CAR’s government in the entire Sango structure is the Country Treasury. As seen in the chart below, this is the 20% of Sango coins that will be unlocked annually over a six-year period. This lock-up will be subject to a four-year cliff, meaning that the government will only receive the coins that have unlocked over the first four years at the end of that period.

Assuming 20% of Sango coin is sold in the public sale for $1 billion, that would value the entire supply at $5 billion ahead of launch. Of course, based on the release schedule in the chart above, 75% of that supply will be locked up for a minimum of two years.

Now, fast forward four years after launch and imagine that Project Sango has been a success. The Sango ecosystem is now a vibrant one with millions of users.

Many crypto companies have setup their African headquarters in CAR and foreigners have bought and locked up significant amounts of Sango coin to acquire land, citizenship and e-residency as well as to co-invest in mining and infrastructure projects in CAR.

In this thought experiment, let’s assume that under such a scenario, the total supply of Sango coin is now valued at $100 billion. This is not far-fetched. Even Dogecoin briefly achieved a market capitalisation of $88 billion in May 2021 despite its lack of utility. What to say of a country coin?

If the Sango market capitalisation reaches $100 billion, that would mean the country treasury was worth $20 billion, with $13.3 billion of that becoming available 48 months following launch. Clearly that would be a game changer for CAR’s finances and would open a new world of possibilities. For reference, CAR’s nominal GDP in 2019 was $2.3 billion.

Easier Said Than Done

Sango is a massive undertaking and lots of things could go wrong, as they often do in the world of finance and investment. Indeed, for this model and similar visions to reach their potential, new global frameworks will be required to manage investor protection and all the other surprises that will inevitably arise. DFIs and MDBs, with their decades of experience mitigating political and commercial risk in development finance would certainly have a role to play.

Nevertheless, it’s clear that the Sango initiative has presented a new model for how crypto technology can be leveraged to mobilise large amounts of risk tolerant private capital that can play a complementary role to other development finance instruments.

Finally, Sango has many moving parts across its legal, digital and physical infrastructure. This article only focused on Sango’s potential implications for development finance, rather than the various aspects of the project itself. If interested in learning more about the latter, the video below will be helpful.

If you enjoyed this article, consider subscribing to our weekly newsletter, where you can find more analysis on developments in the African crypto space.