In addition to the damage caused by the alleged mismanagement of user funds, FTX will leave behind a gap in the African crypto ecosystem.

The events we witnessed over the past week in the crypto space were nothing short of stunning. Last Friday, FTX exchange filed for bankruptcy. A key question is how one of the world’s largest crypto exchanges ended up in this situation.

The facts are evolving rapidly, but the emerging consensus is that FTX lent up to $10 billion in customer assets to its affiliated trading arm, Alameda Research. As to what Alameda did with these funds, one explanation provided in a New York Times article published on Monday is that the funds were used to repay loans that Alameda took to make “venture capital investments.”

Some commentators have questioned this explanation, arguing that Alameda’s VC investments were not large enough to account for all the missing funds.

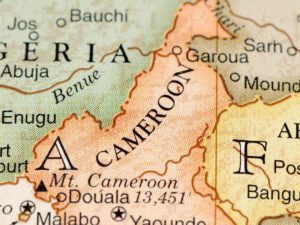

Nigeria’s Nestcoin Comes Forward

After FTX filed for bankruptcy and it became clear that users will face a long process to recover any remaining funds held by the exchange, speculation was rife as to what the resulting fallout will be for the crypto industry.

The African ecosystem didn’t have to wait long to find out, as on Monday 14 November, Nigeria’s Nestcoin revealed that a large portion of its funds were stored on FTX. Additionally, Nestcoin confirmed that the company would have to reduce its staff in order to reposition the company. The Financial Times later reported that Nestcoin held the remaining $4 million out of the $6.45 million it raised earlier this year on FTX.

Given FTX’s strong presence in Africa, Nestcoin is unlikely to be the only entity that will be impacted by the developments at FTX. Up and down the continent, individuals from different walks of life will face adverse consequences due to decisions made at FTX’s HQ in the Bahamas. This is the first blow delivered on users in Africa by the fall of FTX.

The Loss of a Key Player

The second blow that the collapse of FTX delivers is the exit of a key player in the African ecosystem. FTX faces serious allegations, which should be dealt with in accordance with the law. Yet, it can’t be denied that the brand was active at the grassroots of African crypto in a way that few crypto brands of its stature are. As one observer put it, “FTX had a good ground-game in Africa.”

Here, much credit can be given to FTX’s former PR & Marketing Manager, Harri Obi, who earnestly spearheaded slick campaigns that won the hearts and minds of users across Africa.

As the saying goes, crypto moves fast, and so we can imagine that other players will move in to fill the gap and provide options to users who seek an alternative to Binance. However, you have to wonder how long it will be before another player matching FTX’s ground-game will show up.

If you enjoyed this article, consider subscribing to our weekly newsletter, where you can find more analysis on developments in the African crypto space.