MFS Africa recently signed on to use Ripple’s On-Demand Liquidity (ODL) solution for cross border transfers. ODL has seen explosive growth and the service now boasts 40 payout markets. But what is it?

On Tuesday 15 November, MFS Africa and Ripple announced a partnership that will see MFS Africa begin leveraging Ripple’s On-Demand Liquidity (ODL) solution for cross-border mobile money payments across Africa.

There’s a lot to unpack here, so let’s walk through one piece at a time.

What Is MFS Africa?

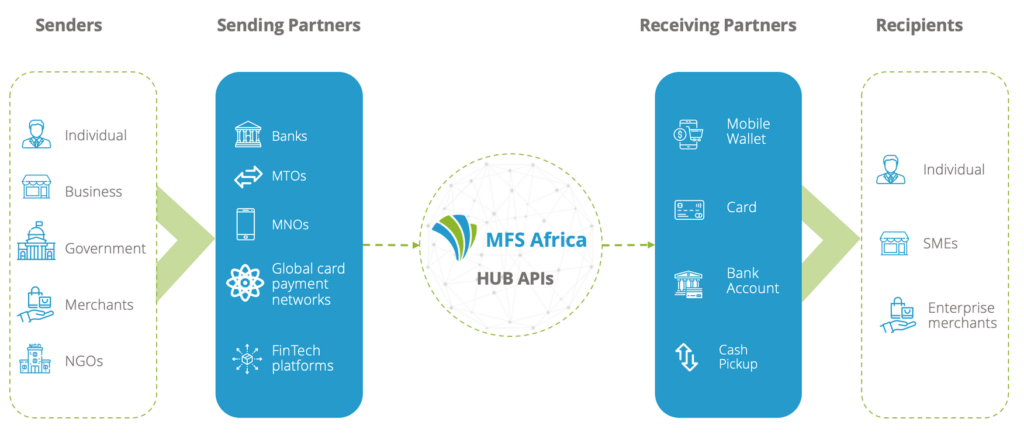

MFS Africa is a digital payments company that enables cross-border payments for remittance companies, financial service providers and global merchants. As of March 2021, MFS Africa was connected to over 320 million mobile money wallets in Africa, which at the time represented roughly 60% of all such wallets on the continent.

According to the company website, MFS Africa aims to establish a borderless payments system in Africa. To achieve this, MFS Africa has been integrating national digital payment schemes, including mobile money, to create a continental digital payment network.

Founded in 2009 by Dare Okoudjou, MFS Africa has its headquarters in Johannesburg, South Africa. Okoudjou previously worked for MTN and is originally from the West African nation of Benin. While working for the telco giant, Okoudjou led the development of MTN’s mobile payment strategy across 21 countries.

What Is Ripple?

Ripple is the company that developed the XRP Ledger, a public blockchain which has XRP as its native cryptocurrency. With a market capitalisation of $18.9 billion (as of writing), XRP is the seventh highest ranked cryptocurrency by market capitalisation, based on data from CoinMarketCap.

Ripple was founded in 2012 by David Schwartz, Jed McCaleb, Arthur Britto and Chris Larsen. Today, the company has a focus on delivering enterprise blockchain and crypto solutions, which include cross-border payments, crypto liquidity and central bank digital currencies (CBDCs).

What is On-Demand Liquidity?

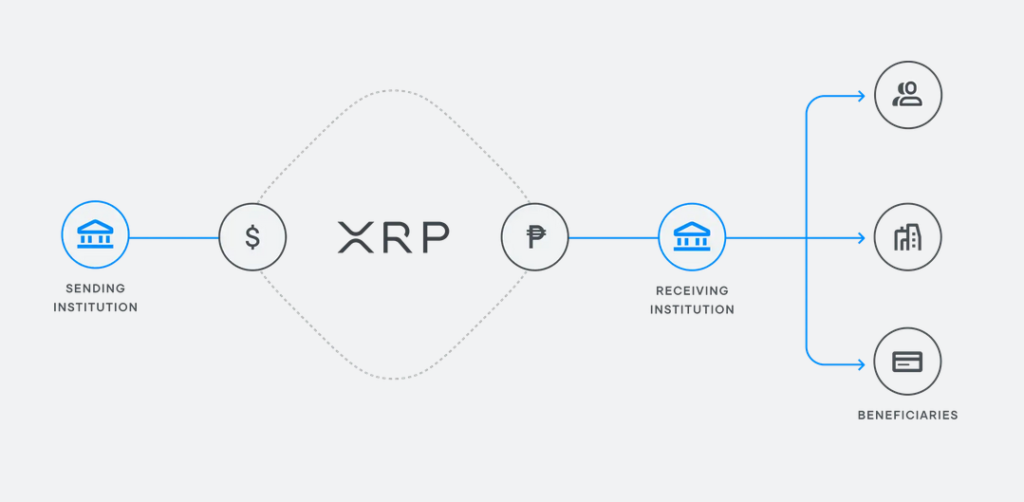

ODL is a payment solution that uses the XRP cryptocurrency for international transfers. The steps described by Ripple for a transfer using ODL are as follows:

- A sending institution requests a fiat-to-fiat quote on pricing and foreign exchange from the receiving institution.

- The receiving institution sends back a quote with pre-negotiated foreign exchange margin.

- The sending institution withdraws XRP from a wallet funded by Ripple and transfers the XRP to the receiving institution via the XRP ledger.

- Upon receiving the XRP a few seconds later, the receiving institution immediately pays out fiat currency to the end-beneficiary of the transfer and in-parallel converts the XRP it received to fiat currency.

- The sending institution is invoiced at the beginning of the following week.

According to Ripple, one advantage of this approach is that speed of settlement is reduced to seconds, whereas settlement can take days in the traditional financial system.

Another advertised advantage of ODL is that it frees up working capital, since there is no need for sending institutions to leave funds sitting around in relevant accounts in other countries in anticipation of transfers (prefunding).

In 2021, total sales of XRP by Ripple in connection with ODL were $1.8 billion, a figure that was eclipsed in the first four months of 2022. At the end of Q3 2020, ODL was available in three markets, and as of Q3 2022, it now has 40 payout markets around the world.

Final Remarks

Crypto bear markets are characterised by depressed trading volumes. And yet this year, ODL has already tripled its 2021 volume before the results from Q4 2022 are in. Clearly, something is going right with this product, and so you have to wonder what sort of fireworks we could see when it’s combined with the giant footprint of MFS Africa.

An open question in all of this is how ODL fits in with stablecoins, which have also been doing well in Africa. If XRP is being used for international transfers, then clearly, XRP is in direct competition with stablecoins for that specific use case.

Yet, in a past interview, a senior executive at Ripple stated that Ripple is not looking to compete with stablecoins and CBDCs, and that XRP should be considered a “bridge asset.” Indeed, a number of stablecoin and CBDC projects are being developed for the XRP Ledger in partnership with Ripple.

In the ODL announcement, MFS Africa’s founder stated that this tie up with Ripple is just the first step in the company’s crypto strategy. If this is what the first step looks like, it’s safe to assume that MFS Africa has big ambitions for the African crypto space.

As crypto winter drags on, we will no doubt see replays of the usual “crypto has no utility” proclamations. Yet, for those paying attention, it’s apparent that the industry is marching on and the technology continues to gain adoption.

Updated 08:50, 23/11/2022.

If you enjoyed this article, consider subscribing to our weekly newsletter, where you can find more analysis on developments in the African crypto space.